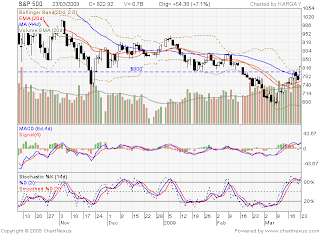

Bounce not been broad-based and volume is average, in terms of price action rather is pretty much neutral. Rights rumours continue to flood the market.

Few scenarios for tomorrow:

1. US bounce, SG gapup to 1,540+ and consolidation day

2. US bounce, SG gapup to 1530+ touch 1,513 and sell

3. US bounce, SG gapup to 1,540+ and fill the gap to 1,588 trendday

4. Nothing happens

Realise the trade-taken maybe given me a check, for the winlose% of it. Psychology wise stil to be self-control to reiterate the importance of expectancy of trading and not rather the winlose% of it

If you lose consecutive 10trades, with $100per trade, is $1,000

If you win consecutive 5trades with $200 per trade, is $1,000 too,

Let your winner run, cut your losers short.